Prestige Professional Management

Your Consumer Resource Specialist

Creating Your Financial Roadmap for Success

Let us Help You Develop a Customized Financial Plan!

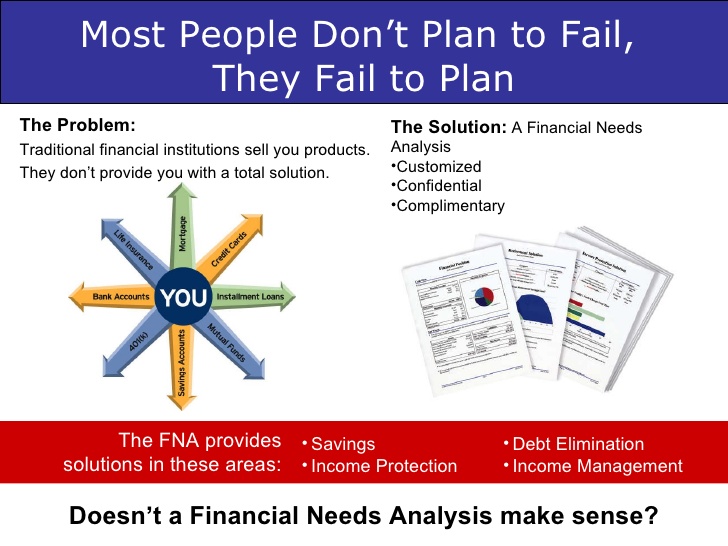

People Don't Plan to Fail. They Fail to Plan!

Your Customized Financial Needs Analysis will provide you with solutions for:

*Credit Repair *Savings *Income Protection *Wealth Creation *Retirement *Debt Elimination