Prestige Professional Management

Your Consumer Resource Specialist

We can help you get started in real estate investing!

Being a beginner real estate investor with zero experience in real estate can seem overwhelming. You may be hesitant to get started. No need to worry. We can help you. We can show you how you can begin with a step-by-step plan from experienced real estate investors. This plan would allow you to learn in stages of investing in real estate, providing you with the knowledge you will need to keep moving forward with confidence. This plan will help you focus on the essentials while ignoring the inessentials. By following the steps, you will save a lot of time and frustration and avoided becoming overwhelmed.

Before You Begin: Get in the Right Mindset

The public often hears about overnight successes because they make for a great headline. However, it’s rarely that simple—they don’t see the research and hard work that goes into successful real estate investing. For this reason, remember to focus on your real estate investing journey and don’t measure your success against someone else’s.

Consistency Is Key

New investors tend to feed off their motivation initially but get frustrated when that motivation wanes. This is why it’s essential to create habits and follow routines that power you through when motivation goes away.

Take the Next Step

Potential real estate investors sometimes dive in headfirst without looking and make things up as they go along. Then, there are those who stay stuck in analysis paralysis and never start. Perhaps you’re a mixture of the two. The best way to accomplish any business or personal goal is to write out every possible step it takes to achieve the goal. Then, order those steps by what needs to happen first. Some steps may take minutes while others take a long time. The point is to always take the next step.

These Are the Steps to Follow

Step 1 – Identify Your Financial Stage

Real estate investing is simply a vehicle to improve your finances. So, before we get into the details of real estate, let’s think about your overall financial picture.

Most new investors eventually want to reach financial independence. You can think of this like the peak of the mountain where your living expenses are all covered by income from investments.

The fundamentals of climbing this mountain are the same whether you invest in real estate or anything else. To reach the peak of the mountain faster, you simply have to increase your savings rate. You can then invest those savings into your chosen assets, like real estate.

We’ll suggest a couple of specific real estate strategies that help with your saving rate in the next section. But for now, you need to identify where you are on the financial mountain. Are you at the very bottom? Half-way up? Or near the top?

What Stage Are You In?

You want to know your current stage because depending on where you are, certain real estate strategies will make more sense than others. We’ll explain some of those strategies in the next step.

So, after thinking for a moment, decide which stage fits you best. Don’t worry, it doesn’t have to be perfect. Then let’s move to Step #2.

Step 2 – Choose a Specific Real Estate Investing Strategy

At this stage, your goal is just to get started. So, let’s begin with something quicker. You can create a big, detailed plan later if you want.

For now, just choose ONE real estate strategy that will help you move from your current financial stage to the next stage (remember Step #1).

Starting with one specific strategy doesn’t mean you won’t have detours or even a complete change of direction later. Life happens, and you have to be flexible. But starting with just one will help you focus. And this will give you the confidence to get started.

Strategies For Wealth Stages One & Two: Survival & Stability

Strategy Goal: Earn extra income, learn, and avoid losses

Keep your day job while you learn what you need to know in the area of real estate investing. This will be the first strategy you will want to explore, until you have the knowledge and experience that you will need in order to avoid any costly pitfalls. Instead of simply renting or sacrificing to buy a home, master lease a residence and rent out bedrooms or units to reduce your payment. Bird dog for other real estate investors to “sniff out” good deals for them and learn the investment acquisition business in the process. You can become a buyer’s agent, help buyers find houses to purchase, and learn the retail housing market in the process. Become a leasing agent, match tenants to properties for landlords or property managers, and learn the landlord business in the process. Manage or supervise remodeling projects for other investors and learn the remodeling business in the process

Strategies For Wealth Stage Three – The Saver

Strategy Goal: Dramatically increase your savings rate by reducing expenses

and/or increasing income

Any of the options in stage one. Hack your housing in order to reduce or eliminate your housing payment. Do a live-in flip in order to build big, tax-free savings. Do a Live-In-Then-Rent by living in an affordable house for 1-2 years and then keeping it as a rental. Start wholesaling real estate for quicker, smaller chunks of cash usually requires investments of time and money in marketing and strong sales skills. Start a non-real estate side-hustle that matches your skills and passions with a need in the marketplace

Strategies For Wealth Stage Four – Growth

Strategy Goal: Grow your smaller net worth into a much bigger net worth

Fix-and-Flip houses to generate big chunks of cash. Remember to save and reinvest your profits!

Build and grow an income property portfolio using one of these plans:

The All-Cash Plan – no debt, pay 100% cash for each property

The Debt Snowball Plan – borrow on a small number of properties, then accelerate debt pay down one property at a time

The Buy 3-Sell 2-Keep 1 Plan – buy 3 rentals, hold, then sell 2 and pay off debt on the third

The Trade-Up Plan – use 1031 tax-free exchanges to build a portfolio with strong equity and income

Self-Directed Retirement Account Plan – use a self-directed IRA or 401k to invest tax-free in private loans (my favorite), rentals, or flips

Strategies For Wealth Stage Five – Income

Strategy Goal: Turn existing equity into investments that produce maximum

income with minimal hassle and risk.

With existing real estate portfolio:

Pay off debt to decrease overall debt levels (0% to 33% loan-to-value), reduce risk, and increase income. Sell low-quality properties and replace them with better ones (using 1031-exchanges, if needed). Refinance any remaining debts that are not optimal with fixed, low-interest, long-term debts

With no existing portfolio or with an insufficient number of properties:

Buy more passive assets like higher-quality residential rentals, net-lease commercial rentals, and/or shares in limited partnerships. Keep overall debt levels low (0 to 33% loan-to-value). Make loans to other investors with funds inside and/or outside of self-directed retirement accounts. Diversify into other asset classes, index funds are my diversification alternative of choice.

Choose a Strategy

If you find yourself attracted to one of the strategies above but you’re intimidated by how to execute it, that’s ok. You still have time to learn. Just make a note of it for now. This kind of focused decision-making process helps you identify knowledge gaps that you need to fill as you go.

For now, just choose one strategy that sounds most interesting and applicable to your situation. Then let’s move to the next step.

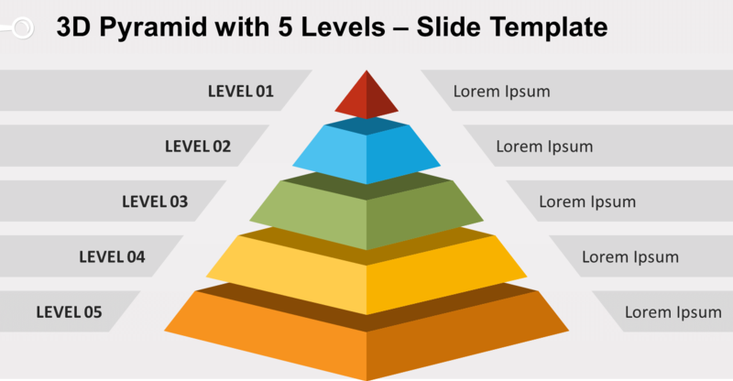

The 5 Levels of Wealth

Stage One

Stage Two

Stage Three

Stage Four

Stage Five

Income

Growth

Saver

Stability

Survival

Learn the Strategies & Techniques that the Experts Use