.

YOU CAN SAVE

MONEY BY:

1. Clip Coupons and Sign Up

For you favorite Store’s

Club Savings

2. Purchase Smaller Quantities

of Perishables

3. Purchase Items on Sale & Always Use Coupons.

4. Purchase Paper Products & Cleaning Items in Bulk

5. Make sure that the expiration or best-to-buy-by dates on the items that you purchase

are still good

6. Brown Bag Your Lunch & Brew Your Own Coffee

7. Purchase produce at your local famers market

Your Money

There is a definite rise in grocery bill costs due to many different reasons. Learning to be a savvy grocery store shopper can help you ward off pain felt from the increased prices by following a few helpful tips.

* Plan your meals before shopping. Before your next grocery store visit, plan your meals ahead, and make a monthly budget of how much you can spend and stick to it.

* Look for coupons. Flip through your Sunday newspaper or Groupon to see if there are any coupons or special savings or order or print coupons online. Plus, if your store offers comparison shopping pull out the ads for things you need to buy each week.

* Know that larger stores buy in bulk. Large supermarkets verses smaller gourmet stores typically offer lower prices because they buy their merchandise in larger quantities and can pass along the savings to you.

* Buy only what's on your list. Before you leave the house, take inventory of what you need and write a detailed list. Once you arrive at the store, only buy the items on your list unless something is on sale. Spontaneous buying is one of the ways you can overspend, not to mention shopping while you’re hungry.

* Use a calculator to track spending. Another helpful idea is to take a mini calculator with you to keep track of the cost as you shop. Your calculator also comes in handy as you compare prices of different brands by dividing the cost of the item by the number of ounces. This formula yields the cost per ounce for an equal comparison. You can also compare the cost of different forms of the same food such as canned, frozen or fresh and determine which is the best value for you.

* Read labels and compare. Be sure to read the labels of your selections so that you know what you’re buying. Even though one item may be cheaper than another, it might not have the nutrient value to make the savings worthwhile. Also, make it a practice to always check the weight of what you’re buying because packaging can be deceiving.

* Resist impulse buying. If you have small children, keep in mind that taking them with you to the store can be a distraction from your list. Plus, shopping with your kids can cause you to impulse buy and rush through your visit leaving no time for comparison shopping.

So, the next time you plan a trip to the grocery store try incorporating a few of these tips and see what a difference it can

make to your pocketbook.

Get Cash Back Every Time You Shop!

What is ibotta?

Ibotta is a free cash back rewards web and mobile app that gives you real cash for everyday purchases when you shop. Ibotta provides thousands of ways for consumers to earn cash on their purchases by partnering with more than 2,700 brands and retailers. Whether you’re buying groceries, clothing, electronics, or wine and beer, Ibotta will pay you cash for your purchases. In fact, Ibotta has paid out over $1.2 billion in cash rewards to more than 40 million users since its founding in 2012.

Avoid the High Cost of Grocery Bills!

MyMoney.gov is the U.S. government's website dedicated to teaching all Americans the basics about financial education. Whether you are planning to buy a home, balancing your checkbook, or investing in your 401k, the resources on MyMoney.gov can help you do it better. Throughout the site, you will find important information from 20 federal agencies government wide.

The tool kit contains the following publications:

Consumer Action Handbook

A resource directory that provides information on how contact specific businesses and local consumer protection offices.

Consumer Advisory on Forex Fraud

Information about foreign currency fraud.

Consumer Information Catalog

Listing of consumer education resources available from the Federal Citizen Information Center.

Get the Facts on Saving and Investing

Provides helpful tips and worksheets for calculating net worth, income, and expenses.

Insuring Your Deposits

Information about how FDIC insures deposit accounts at banks and savings associations.

Money Smart

Learn about the FDIC’s financial education program for adults.

Questions You Should Ask About Your Investments

Advice on questions to ask before investing.

Savings Fitness: A Guide to Your Money and Your Financial Future – Provides guidance on preparing a personal savings plan and for retirement.

Social Security: Understanding the Benefits

Get details on retirement, disability, survivor's benefits, Medicare, SSI and more.

Prestige Professional Management

Your Consumer Resource Specialist

Do You Want to Learn How to Save, Invest, & Manage Your Money Better?

MyMoney.gov can help you!

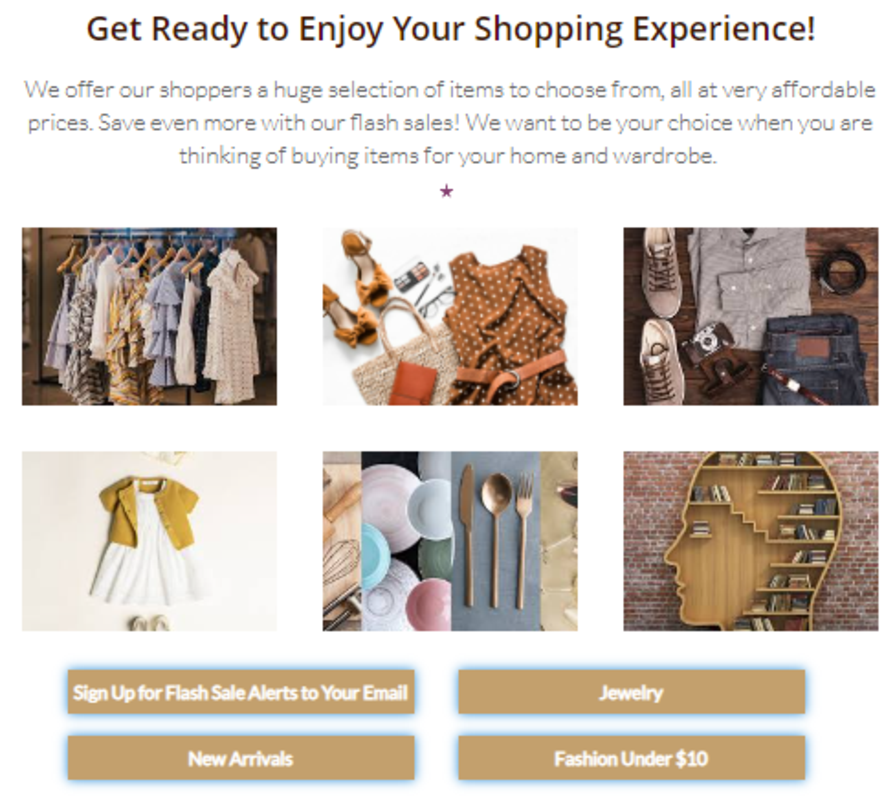

Discount Shopping